Layering life insurance policies

14/07/2025

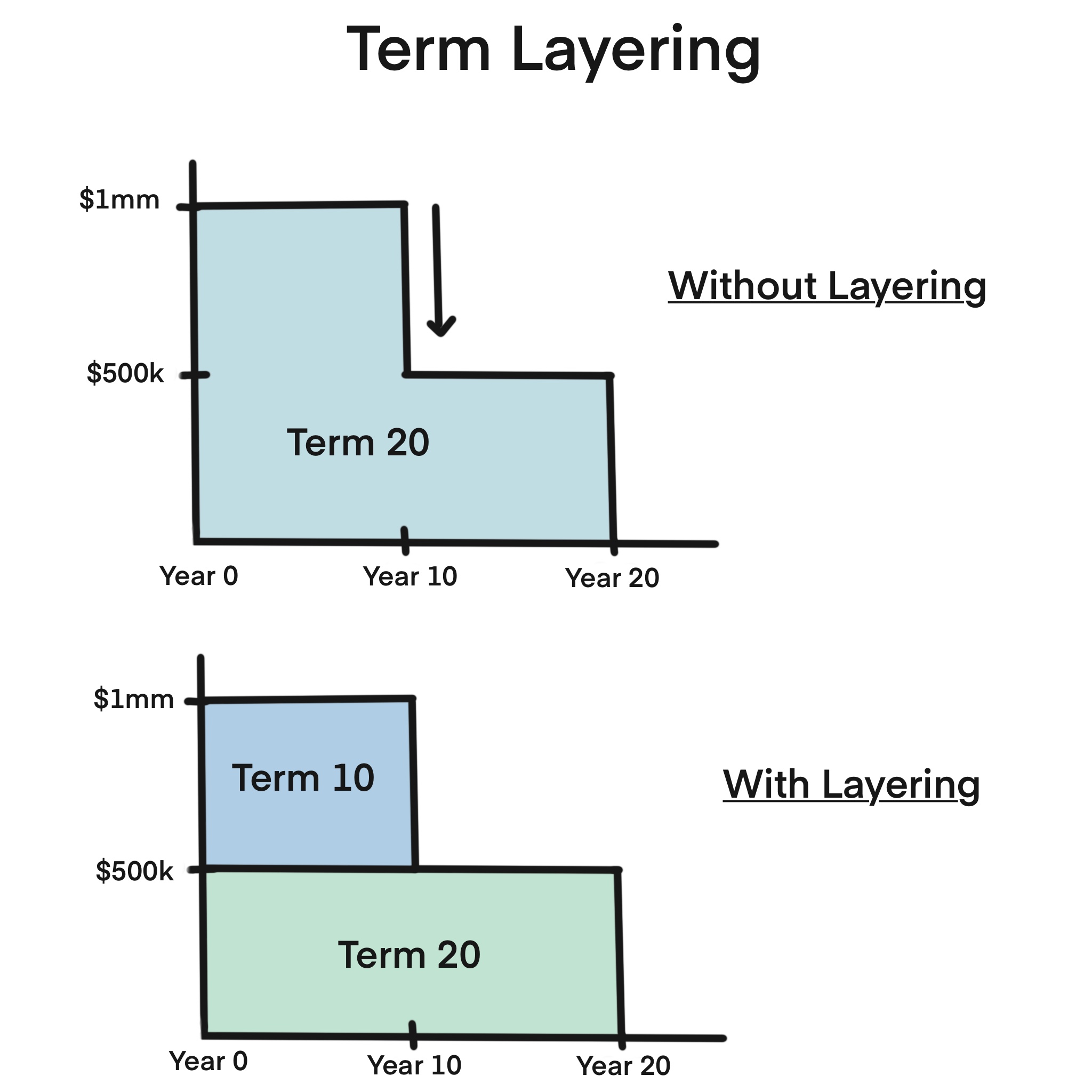

Layering of life insurance policies is a strategy that can allow you to inexpensively decrease your coverage over time. The motivation is that you may consider that you need $1,000,000 of coverage for the next 10 years, and then only need $500,000 of coverage for the following 10 years. Layering of policies allows you to accomplish this.

Term Layering

Term Life Insurance has the implicit assumption that you need a level amount of coverage for a specific amount of time, and after that time you don’t need the coverage. For example, $500,000 of term 20 life insurance will provide you level death benefit of $500,000 for a full 20 years. Similarly, a $500,000 term 10 policy will provide $500,000 of level coverage for only 10 years.

So if you needed $1MM of coverage for the next 10 years and then $500,000 of coverage for the following 10 years, you could purchase a term 20 policy at $1,000,000 and then after 10 years reduce the coverage by half. You’ll have the desired reduction in coverage, but you’ll in the first 10 years you’ll be paying term 20 premiums for half the coverage that you don’t expect to keep for the full 20 years.

A possibly cheaper alternative is to layer a term 10 policy and a term 20 policy, each for $500,000. This gives you a total of $1,000,000 for the first 10 years, but with slightly cheaper premiums (as $500,000 of term 10 plus $500,000 of term 20 is cheaper than $1,000,000 of term 20). After 10 years, you simply cancel the term 10 policy and have the last 10 years of the term 20 coverage remaining.

Some cautions. First, assuming that you need a reduced amount of coverage over time may seem mathematically correct. But in practice, incomes go up, kids can become more expensive, people buy larger homes, etc And all this would be counter to a lowering of life insurance coverage over the years.

Secondly, the price difference between $500,000 of term 10 + $500,000 of term 20 vs $1,000,000 of term 20 may be minimal – it’s small enough that many people will simply purchase the straight term 20 and have the added benefit that if they’re insurance needs do not drop over time then they’re still properly covered. If you’d like to see the price difference, please call our office and we’ll provide these quotes over the phone.

Term and Permanent Layering

If you assume that you need a large amount of life insurance during your working/family years, then need $0 coverage after that, then term life insurance is the correct choice. However you may determine that you need a large amount of coverage now, but a smaller – but not 0 – amount of coverage after retirement. The least expensive way to do this is through layering term and permanent life insurance coverage.

e.g. Say you need $1,000,000 of life insurance for 20 years, then you want $50,000 of coverage after that, for life. Then you can layer with $50,000 of permanent life insurance + $950,000 of 20 year term insurance. Total coverage is $1,000,000 for 20 years, then you drop the term 20 coverage and are left with $50,000 of life insurance for life. The benefit in this layering is that when the term 20 coverage is dropped and you’re left with $50,000 of permanent life insurance – the $50,000 life insurance premiums are locked in for someone 20 years younger than you (since you bought it 20 years ago). And, there’s no medical exam required since again, the coverage is in force.

By contrast, you could purchase the straight term 20 for $1,000,000 and then in 20 years drop the term life insurance coverage and purchase a new permanent policy for $50,000. This has two drawbacks. First, you have to qualify with a medical exam and we don’t know if you’ll be able to do that in 20 years. Certainly our health isn’t generally getting better as we get older. Secondly, and again, the premiums will be more expensive.

Despite the drawbacks, the second approach is what most Canadians take – the straight term 20 policy now and then worry about permanent life insurance in 20 years. This is actually fine as long as your term policy is renewable and convertible. The convertible option guarantees your health and insurability to purchase a permanent policy later in life (generally up to age 71 or so) so with a renewable and convertible term you don’t need to worry about becoming uninsurable in the future and not being able to get a permanent policy. However the premiums of course will be more expensive than the layering option, because you’ll be 20 years older. Most people accept this, with the premise that deferring higher premiums out 20 years (when hopefully kids are financially independent, debts paid down, and we have retirement savings) is better than paying higher premiums now (when we have big mortgages, expensive kids, debts, not enough savings, etc). A renewable and convertible term policy, that guarantees the ability to purchase permanent life insurance means you don’t have to worry about insurability and this becomes strictly a financial ‘pay less now, or more later’ decision – and as I noted, most people prefer the ‘more later’ option.

Now that you understand term layering, you may find our article on Term Stacking of interest – it’s another way to save money on your term life insurance benefits.